Understanding Short Selling on PrimeXBT: Strategies and Insights

In the dynamic landscape of cryptocurrency trading, short selling has emerged as a vital strategy for traders looking to capitalize on market volatility. On platforms like PrimeXBT, traders can efficiently execute short positions, leveraging market downturns to generate profits. In this article, we will explore the nuances of Short selling on PrimeXBT how to short on PrimeXBT, delve into effective strategies, and understand the associated risks and rewards.

What is Short Selling?

Short selling refers to the practice of borrowing an asset, selling it at the current market price, and then buying it back later at a lower price. The profit is realized when the asset is purchased back, ideally at a price that is significantly lower than the initial sale price. This strategy is commonly used when traders anticipate a decline in the value of a security or an asset.

How Does Short Selling Work on PrimeXBT?

PrimeXBT offers a user-friendly interface for traders to engage in short selling. The process typically involves the following steps:

- Create an Account: If you’re new to PrimeXBT, start by creating an account and completing the necessary verification steps.

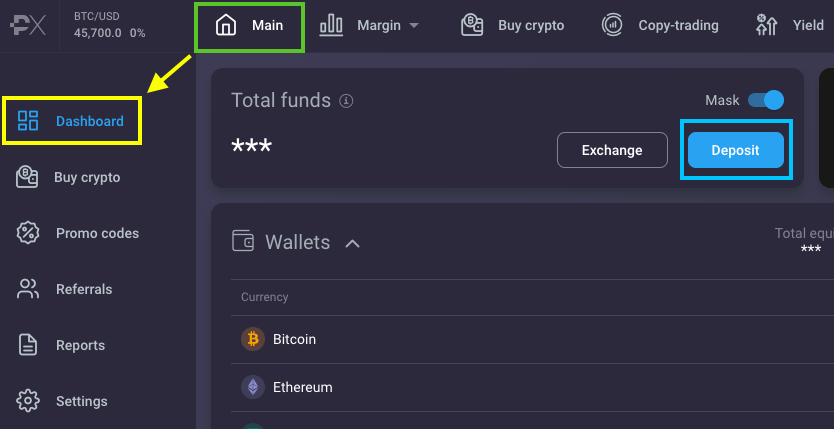

- Fund Your Account: Deposit funds into your PrimeXBT account. The platform supports multiple cryptocurrencies and fiat currencies for deposits.

- Select an Asset: Choose the cryptocurrency or asset you wish to short. PrimeXBT provides a range of digital assets with significant liquidity.

- Open a Short Position: Using the trading interface, you can open a short position by selecting the desired amount and confirming your trade.

- Monitor the Market: Keep an eye on market trends and the asset’s price movements to determine the optimal time to close your position.

- Close Your Position: When the asset’s value has declined to your target price, close the position to realize your profit.

Strategies for Successful Short Selling

To maximize your gains while minimizing your risks in short selling, consider the following strategies:

1. Fundamental Analysis

Understanding the fundamentals of an asset is crucial. Analyze news, updates, and market conditions that may affect the price of the asset you are shorting. Events like regulatory changes, technological advancements, or conflicts can significantly impact prices.

2. Technical Analysis

Utilize charts and indicators to identify trends and potential reversal points. Look for patterns that suggest a price decline, such as head and shoulders or double tops.

3. Set Stop-Loss Orders

To mitigate risks, always set stop-loss orders. This ensures that if the market moves against your position, your losses are limited to a predefined level. Remember that short selling can potentially lead to unlimited losses since assets can theoretically rise indefinitely.

4. Use Leverage Wisely

PrimeXBT offers leverage, allowing you to enhance your trading positions. While leverage can amplify gains, it also increases risks. Use it judiciously and understand the implications of margin calls.

Benefits of Short Selling on PrimeXBT

Short selling offers several advantages for traders, particularly on PrimeXBT:

1. Profit from Market Downtrends

Short selling allows you to profit even when the market is declining. This is particularly useful during bearish trends or market corrections.

2. Hedging Opportunities

If you hold long positions in various assets, short selling can act as a hedge against potential losses. By taking short positions in correlated assets, you can protect your portfolio during downturns.

3. Increased Market Liquidity

Short sellers contribute to market liquidity, ensuring there are enough buyers and sellers in the market. This can enhance the overall trading experience on platforms like PrimeXBT.

Risks Associated with Short Selling

While short selling can be lucrative, it also comes with significant risks that traders should be aware of:

1. Unlimited Loss Potential

Unlike traditional buying (long positions) where your maximum loss is limited to your initial investment, short selling exposes you to unlimited losses if the market goes against you.

2. Market Volatility

Cryptocurrency markets are notoriously volatile. Sudden price spikes can lead to rapid losses for short sellers, making it essential to continuously monitor positions.

3. Regulatory Risks

Changes in regulations can impact the feasibility of short selling in certain markets. Stay updated on any legal changes pertaining to cryptocurrency trading.

Conclusion

Short selling on PrimeXBT can be an effective strategy for experienced traders looking to leverage market downturns for profit. However, it requires a clear understanding of the risks and the implementation of sound trading strategies. By equipping yourself with knowledge, using technical and fundamental analyses, and employing risk management techniques, you can navigate the complexities of short selling in the cryptocurrency market. Whether you are looking to hedge your portfolio or capitalize on bearish movements, PrimeXBT offers the tools and resources to support your trading endeavors.